Page 9 - Moreno Valley 2025 Citizens Guide to the Budget

P. 9

BUDGET AT A

GET INVOLVED GLANCE

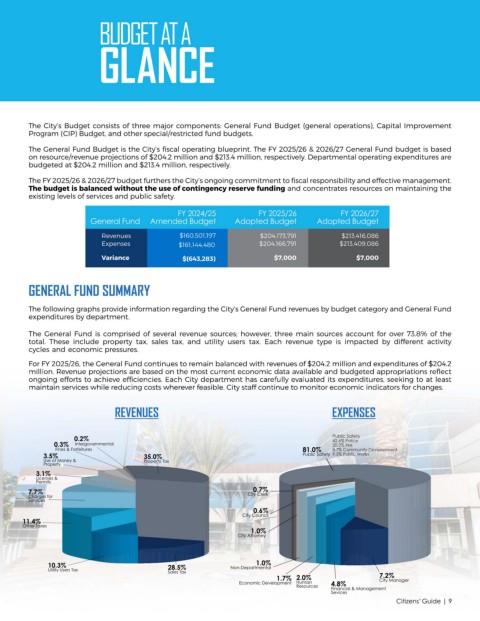

The City’s Budget consists of three major components: General Fund Budget (general operations), Capital Improvement

Program (CIP) Budget, and other special/restricted fund budgets.

The General Fund Budget is the City’s fiscal operating blueprint. The FY 2025/26 & 2026/27 General Fund budget is based

on resource/revenue projections of $204.2 million and $213.4 million, respectively. Departmental operating expenditures are

budgeted at $204.2 million and $213.4 million, respectively.

The FY 2025/26 & 2026/27 budget furthers the City’s ongoing commitment to fiscal responsibility and effective management.

The budget is balanced without the use of contingency reserve funding and concentrates resources on maintaining the

existing levels of services and public safety.

FY 2024/25 FY 2025/26 FY 202 /2

General Fund Amended Budget Adopted Budget Adopted Budget

Revenues $16 , ,1 $204,173,791 $213,416,086

Expenses $161, 44,48 $204,166,791 $213,409,086

Variance $(64 , ) $7,000 $7,000

GENERAL FUND SUMMARY

The following graphs provide information regarding the City’s General Fund revenues by budget category and General Fund

expenditures by department.

The General Fund is comprised of several revenue sources; however, three main sources account for over 7 .8% of the

total. These include property tax, sales tax, and utility users tax. Each revenue type is impacted by different activity

cycles and economic pressures.

For FY 2025/26, the General Fund continues to remain balanced with revenues of $204.2 million and expenditures of $204.2

For FY 2025/26, the General Fund continues to remain balanced with revenues of $204.2 million and expenditures of $204.2

million. Revenue projections are based on the most current economic data available and budgeted appropriations reflect

million. Revenue projections are based on the most current economic data available and budgeted appropriations reflect

ongoing efforts to achieve efficiencies. Each City department has carefully evaluated its expenditures, seeking to at least

ongoing efforts to achieve efficiencies. Each City department has carefully evaluated its expenditures, seeking to at least

maintain services while reducing costs wherever feasible. City staff continue to monitor economic indicators for changes.

maintain services while reducing costs wherever feasible. City staff continue to monitor economic indicators for changes.

REVENUES EXPENSES

0. % Public Safety

4 . % Police

0. te e e t . % Fire

Fines & Forfeitures 81.0% . % Community Development

3. % 3 .0% Public Safety 9. % Public Works

Use of Money & Property Tax

Property

3. %

Licenses &

Permits

7.7% 0.7%

Charges for City Clerk

Services

0.6%

City Council

1 . %

Other Taxes

1.0%

City Attorney

1.0%

0. % 2 . % Non-Departmental

Utility Users Tax

Sales Tax

1.7% 2.0% 7.2%

City Manager

Economic Development Human 4.8%

Resources

Financial & Management

Sevices

Citizens’ Guide | 9