Page 13 - Moreno Valley 204 PAFR

P. 13

E

l

l

E

l

y E

E

r

o

a

V

no

C

l

i

t

y

t

i

i

r

t

u

C

M

MorEno VallEy ElECtriC utility

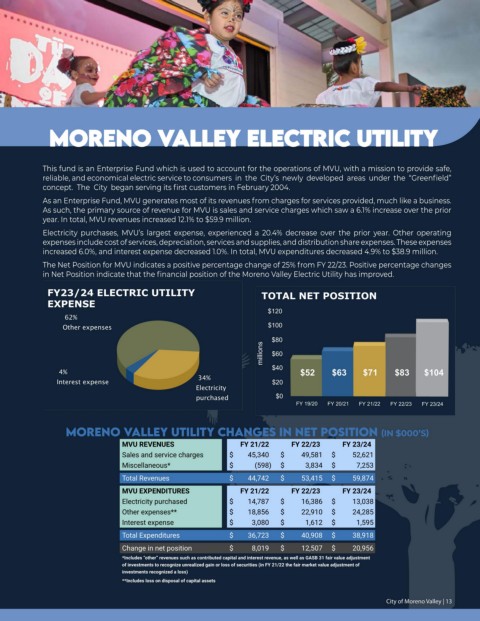

This fund is an Enterprise Fund which is used to account for the operations of MVU, with a mission to provide safe,

reliable, and economical electric service to consumers in the City’s newly developed areas under the “Greenfield”

concept. The City began serving its first customers in February 2004.

As an Enterprise Fund, MVU generates most of its revenues from charges for services provided, much like a business.

As such, the primary source of revenue for MVU is sales and service charges which saw a 6.1% increase over the prior

year. In total, MVU revenues increased 12.1% to $59.9 million.

Electricity purchases, MVU’s largest expense, experienced a 20.4% decrease over the prior year. Other operating

expenses include cost of services, depreciation, services and supplies, and distribution share expenses. These expenses

increased 6.0%, and interest expense decreased 1.0%. In total, MVU expenditures decreased 4.9% to $38.9 million.

The Net Position for MVU indicates a positive percentage change of 25% from FY 22/23. Positive percentage changes

in Net Position indicate that the financial position of the Moreno Valley Electric Utility has improved.

FY23/24 ELECTRIC UTILITY TOTAL NET POSITION

EXPENSE

$120

62%

$100

Other expenses

$80

millions $60

4% $40 $52 $63 $71 $83 $104

34%

Interest expense $20

Electricity

purchased $0

FY 19/20 FY 20/21 FY 21/22 FY 22/23 FY 23/24

MorEno VallEy utility CHangES in nEt poSition (IN $000’S)

MVU REVENUES FY 21/22 FY 22/23 FY 23/24

Sales and service charges $ 45,340 $ 49,581 $ 52,621

Miscellaneous* $ (598) $ 3,834 $ 7,253

Total Revenues $ 44,742 $ 53,415 $ 59,874

MVU EXPENDITURES FY 21/22 FY 22/23 FY 23/24

Electricity purchased $ 14,787 $ 16,386 $ 13,038

Other expenses** $ 18,856 $ 22,910 $ 24,285

Interest expense $ 3,080 $ 1,612 $ 1,595

Total Expenditures $ 36,723 $ 40,908 $ 38,918

Change in net position $ 8,019 $ 12,507 $ 20,956

*Includes “other” revenues such as contributed capital and interest revenue, as well as GASB 31 fair value adjustment

of investments to recognize unrealized gain or loss of securities (in FY 21/22 the fair market value adjustment of

investments recognized a loss)

**Includes loss on disposal of capital assets

V

| 13

alley

eno

Cit

y of M

City of Moreno Valley | 13

or