Page 14 - Moreno Valley City 2025 PAFR

P. 14

n

g

t

lOng terM debt

l

O

e

e

b

t

r

M

d

Governments, just like businesses and individuals, determining the interest rate on bonds. A strong credit

must finance certain purchases with debt. The key is rating allows the City to borrow funds at lower interest

to match the life of the assets being purchased, with rates, reducing the cost of financing infrastructure

the term of the debt payments. Accordingly, the City’s projects and other capital investments.

debt is predominantly related to long-lived capital

assets. For more information on the City’s debt program, visit

the Investor Relations page on the City’s website.

At year-end, the City’s governmental activities had

$133.9 million in bonds, certificates of participation,

WHY DOES THE CITY BORROW

lease liability, SBITA, compensated absences, Pension

and Other Post-Employment Benefits (OPEB) liability Local governments issue bonds to pay for large,

and self-insurance claims and judgments. expensive, and long-lived capital projects, including

roads and electric utilities. Without issuing debt, these

The City’s credit rating is AA- by Standard & Poor’s. important infrastructure needs would be unmet. While

A key factor in achieving and maintaining the strong local governments can sometimes pay for capital

rating is the action of the City Council and the City investments with current revenues, borrowing allows

Manager to balance the City’s General Fund budget. them to spread the costs across multiple generations

The credit rating is the most important factor in due to their long-term benefit.

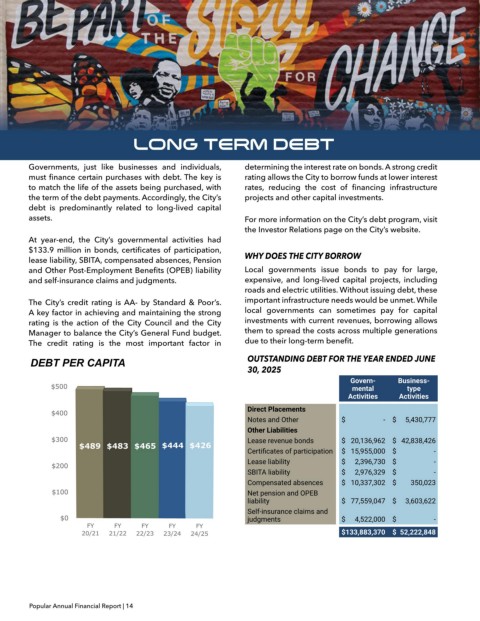

DEBT PER CAPITA OUTSTANDING DEBT FOR THE YEAR ENDED JUNE

30, 2025

Govern- Business-

$500 mental type

Activities Activities

Direct Placements

$400

Notes and Other $ - $ 5,430,777

millions $300 $489 $483 $465 $444 $426 Other Liabilities $ 20,136,962 $ 42,838,426 -

Lease revenue bonds

$ 15,955,000

$

Certificates of participation

Lease liability $ 2,396,730 $ -

$200

SBITA liability $ 2,976,329 $ -

Compensated absences $ 10,337,302 $ 350,023

$100 Net pension and OPEB

liability $ 77,559,047 $ 3,603,622

Self-insurance claims and

$0 judgments $ 4,522,000 $ -

FY FY FY FY FY

20/21 21/22 22/23 23/24 24/25 $ 133,883,370 $ 52,222,848

Popular Annual Financial Report | 14